UWL Freight Market Update | Week 27

- By:

- Kellie Lynch

- Date:

- Jul 2, 2020 8:04:20 AM

- Categories:

- Ocean Freight, Regulatory Updates, Resources, Market Updates, North America, Asia, Shipping & Logistics News, Air Freight

This week's latest ocean freight, air freight, and trade & compliance updates.

Ocean Freight 🛳️

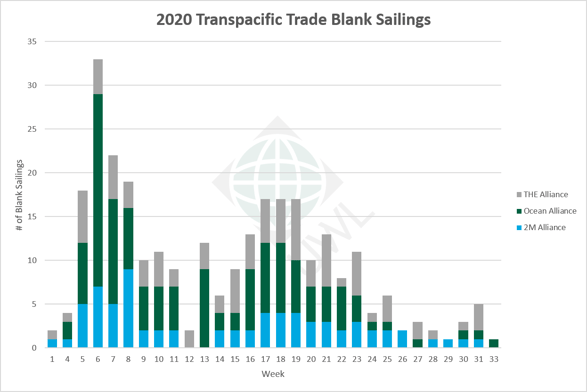

Blank sailings have continued this month, but there are less blank sailings expected in July than there were in May and June. However, capacity remains tight across the board. Rolling issues are continuing into July for cargo bound to both the USWC and USEC. Make sure to book at least 2-3 weeks in advance to secure space. Now, let's take a look at ocean freight market conditions by trade lane.

Asia to USWC

Space to the USWC is still very tight as there is currently a big rush to get cargoes shipped out before mid-July. Carriers reinstated some PSW sailings and added extra loaders which has relieved a bit of the space pressure, but rolling is still an issue.- Rates: Up ⬆️

- GRI on July 1 (Pending GRI on July 15)

- Capacity: Tight

- Special Notes:

- Central China > USWC: Full due to PPE cargoes, Ningbo to PSW is easier due to extra loaders.

- Northern China > USWC: Tight. Dalian space is easier.

- Southern China > USWC: Tight.

Asia to USEC

Space from Central China to the USEC is full and carriers are implementing weight limitations for sailings transiting the Panama Canal due to the dry season.

- Rates: Up ⬆️

- GRI on July 1 (Pending GRI on July 15)

- Capacity: Very tight across the board

- Special Notes:

- Central China > USEC: Full due to PPE cargoes. COSCO and ONE have weight limitations.

- Northern China > USEC: Tight. Dalian space is easier. Some space open from Qingdao on HMM/ONE EC2 service.

- Southern China > USEC: Full.

North American Exports

Space continues to be tight and blank sailings are affecting equipment availability in inland locations and Houston in particular. Nine additional blank sailings were announced for the Trans-Atlantic trade, bringing that total to 23 blank sailings in Q3, JOC reported.

Blank Sailings By the Numbers

| Total | 2M Alliance | Ocean Alliance | THE Alliance | |

| Q1 | 148 | 36 | 76 | 36 |

| Q2 | 130 | 33 | 50 | 47 |

| Q3 | 12 | 4 | 3 | 5 |

| Total | 290 | 73 | 129 | 88 |

Note: Report only covers cancelled transpacific sailings from East Asia to all USA and Canada destinations. Updated July 1, 2020.

For a complete list of announced blank sailings, download this report.

(Excel .XLSX 1.33 MB) | Updated on July 1, 2020

Air Freight ✈️

🌏 Asia

Demand for airfreight is beginning to slow down now that importers have built up their inventories of PPE, FreightWaves reports. Rates are still high but slowly returning to normal levels, and congestion at major Chinese airports, like Shanghai, has improved.

Importers are shifting from moving PPE products like masks and gloves, to moving products that are popular during COVID-19 quarantine, like "athleisure" clothing, office equipment, and home improvement supplies.

Delta Airlines has restored international service from Seattle (SEA) to Shanghai (PVG) and service from Detroit (DTW) to Shanghai (PVG) will be restored beginning July 1.

🌎 Americas

We are still seeing ground handling delays across major US hubs. US air export volume is growing as businesses return to work, however, capacity still remains tight.

Airlines are expected to add some USA domestic capacity in July and August.

Trade & Compliance 🌐

USTR considers extending Section 301 List 1 exclusions that expire on Sept. 1

The USTR is requesting comments as it considers possibly extending tariff exclusions for Chinese import products on Section 301 List 1, which are set to expire on Sept. 1, for another year.

Exclusions will be evaluated independently, with the primary focus being whether the product remains only available in China despite the imposition of the tariffs.

Comments will be accepted beginning July 1 and are due by July 30.

USTR considers extending Section 301 List 2 exclusions that expire on Sept. 20

The USTR is requesting comments as it considers possibly extending tariff exclusions on Chinese imports on Section 301 List 2 for another year.

Exclusions will be evaluated independently, with the primary focus being whether the product remains only available in China despite the imposition of the tariffs.

Comments will be accepted beginning July 1 and are due by July 30.

- Visit USTR's portal here to leave your comments

- See notice in the Federal Register

- View the list of products

USTR considers extending Section 301 List 2 exclusions that expire on Oct. 2

In addition to the Section 301 List 2 exclusions that expire on Sept. 20, the USTR is also considering extending the Section 301 List 2 product exclusions that expire on Oct 2.

Exclusions will be evaluated independently, with the primary focus being whether the product remains only available in China despite the imposition of the tariffs.

Comments will be accepted beginning July 1 and are due by July 30.

- Visit USTR's portal here to leave your comments

- See notice in the Federal Register

- View the list of products

Latest Market News - Don't miss these stories

Take a deeper dive into the current freight market conditions by checking out these news stories.

- Trans-Pacific carriers push third GRI in a month (JOC)

- Container lines extend trans-Atlantic capacity cuts (JOC)

- Shippers are right, services are getting worse says Sea-Intelligence (Container-News)

- Major lines continue service cancellation programmes (Container-News)

- Warehouse demand surges as retailers reset supply chains (WSJ)

- Need for speed drives ships toward Pacific ports (American Shipper)

We will continue to keep you informed of the latest market developments.

Should you have any questions or if you need assistance, please contact your local UWL customer service representative or reach out here.