UWL Freight Market Update | New Global Trade Order?

- By:

- UWL

- Date:

- May 8, 2025 11:41:20 AM

- Categories:

- International Trade News, Ocean Freight, Supply Chain, Regulatory Updates, Freight Forwarding, Market Updates, North America, Shipping & Logistics News, 3PL, Sun Chief

Your Monthly Logistics Round Up - Timely insights for navigating today's freight markets.

Global trade is potentially entering a new era, shaped by evolving tariff policies, sourcing shifts, and rising geopolitical complexity. As importers reassess their strategies, staying informed and agile is more important than ever. This month’s update explores the key developments influencing today’s freight landscape.

In this issue:

-

Industry Watch

-

A New Era in Trade

-

Ocean Freight Trends

-

Air Cargo Snapshot

-

Port and Inland Ops

-

Sun Chief Express Supports SE Asia Shift

Industry Watch

⏸️ U.S. Shippers Tap the Brakes

Broader tariff uncertainty is causing importers to pause long-term procurement or sourcing expansions. While not a halt, it’s a moment of recalibration, especially for those dependent on Chinese and Southeast Asian supply chains. Read more →

🌏 Vietnam Seeks to Deescalate Trade Tension

As the U.S. weighs a steep 46% tariff on Vietnamese imports, Vietnam has initiated talks aimed at heading off major trade friction. The move follows parallel efforts to strike new agreements with India and Egypt, while also tightening controls on transshipment practices flagged by U.S. Customs. Read more →

🌿 Carbon Rules on the Horizon for Ocean Freight

Shipping lines will soon face new emissions costs as regulators move forward with carbon pricing frameworks set to phase in by 2028. The policy could reshape fuel use and routing strategies—though key implementation details are still under review. Read more →

📉 Apparel Imports Face Headwinds

U.S. apparel shippers are preparing for a potential dip in import volumes, with new tariff measures prompting retailers to rethink inventory strategies. While not a collapse, the slowdown is driven by cautious ordering as brands assess pricing pressures and shifting sourcing plans. Diversification beyond Vietnam and China is gaining traction, especially among mid-size fashion labels. Read more →

.png?width=900&name=Earth%20Month%20Header%20(1).png)

🌍 A New Era in Trade: Tensions, Tariffs, and Tactics

April brought renewed complexity to global trade, with developments unfolding across U.S. policy, international defense, and diplomacy—all with major implications for containerized freight and sourcing strategies.

📈 India’s Exports Reach All-Time High

India recorded record-breaking exports of $824.9 billion for FY 2024–25, up 6% year-over-year. Services exports led the surge, growing 13.6% to $387.5 billion, with March alone seeing an 18.6% spike. Goods exports to the U.S. jumped 11.6%, contributing to a 16.6% rise in India’s trade surplus with America. The data underscores India’s growing role in global trade as it pursues trade agreements with the EU and UK and navigates new U.S. tariffs. Read more →

⚓ Fee Levies on Foreign-Built Vessels Take Shape

Following a year-long Section 301 investigation, the U.S. Trade Representative has proposed phased fees on foreign-built vessels calling at U.S. ports—specifically targeting Chinese-made ships. Additional tariffs of up to 100% are also under review for Chinese-built containers, chassis, and ship-to-shore cranes. A public hearing is scheduled for May 19. Read more →

🛰️ U.S.-Asia Defense Ties Deepen Through Joint Drills

Nearly 14,000 troops, including 9,000 Americans, participated in this year’s Balikatan military exercises across the Philippines. The drills, among the largest ever held in the region, emphasize missile defense and naval coordination—reinforcing a growing U.S.-Philippines alliance backed by $500M in annual U.S. defense funding through 2029. Read more →

🤝 U.S. and China to Hold Geneva Talks Saturday

In a critical diplomatic step, U.S. Treasury Secretary Scott Bessent and chief trade negotiator Jamieson Greer will meet Chinese Vice Premier He Lifeng in Geneva this weekend. The meeting, confirmed by Washington, marks the first direct talks in weeks and comes amid soaring bilateral tariffs, currently 145% and 125% respectively. The announcement spurred equity market optimism across both the U.S. and Asia. Read more →

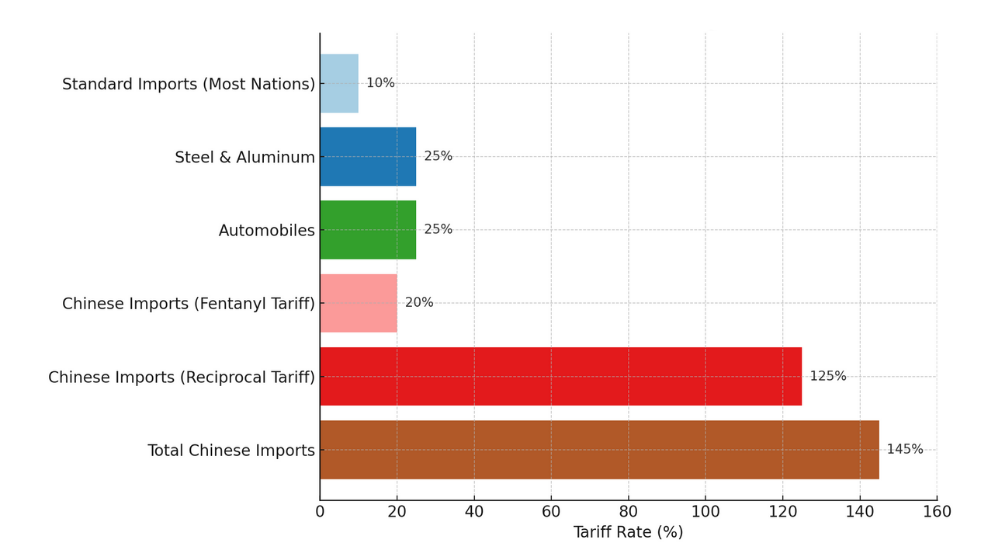

U.S. Tariff Rates on Global and Chinese Goods:

Freight Market Trends

Ocean Freight Snapshot

Transpacific Ocean Rates

The ocean market remains steady, but rising tariffs are making some contracted lanes uneconomical. Carriers are watching volumes closely and may adjust future commitments if space goes unused. Post–May Day demand shows little change, though GRIs and PSS are being pushed, especially from Southeast Asia.

Booking Trends

Many shippers are locked into contracts they now struggle to execute. This mismatch could lead to a pullback in future capacity offers. In the meantime, spot market activity remains moderate, but could heat up quickly if trade conditions shift or importers return to restocking.

Peak Season Outlook

Outlook remains mixed. Q3 volumes may rise modestly, but much hinges on U.S.–China developments. Importers are drawing down inventories while watching for policy changes that could trigger a sharp upswing in bookings.

Far East – US West Coast Spot Rate Trend | Source: Xeneta

Piracy Resurgence Raises Concerns

Global piracy incidents rose 35% in Q1, with the Singapore Strait accounting for most attacks. While not yet affecting major lanes, renewed hijackings and kidnappings could influence future routing and insurance costs.

Air Freight Snapshot

China–U.S. E-Commerce Disruption

The end of the U.S. De Minimis exemption on May 2 has disrupted e-commerce air cargo flows from China, which make up nearly half of the China–U.S. air trade and 6% of global volume. Carriers like Kalitta have canceled flights, while platforms like Temu are pivoting to U.S.-based fulfillment. FBA and SHEIN volumes remain steady, but general cargo bookings are seeing delays as shippers reassess landed costs.

Rate and Capacity Update

Global airfreight spot rates rose 3% year-over-year in April. A 24% drop in jet fuel prices helped ease some cost pressures, but new tariffs on Chinese goods continue to weigh on margins. In South Asia, Indian carriers are rerouting around closed Pakistani airspace, reducing lift and increasing fuel burn.

.png?width=1100&name=Port%20of%20LBG%20(1).png)

Port and Inland Ops

Trailer Orders Defy Expectations

U.S. trailer orders rose sharply in March, hitting 21,516 units—a 70% increase year-over-year and the fifth straight month above 20,000. While the broader order season remains down overall, this uptick suggests renewed investment in equipment. However, rising manufacturing costs and extended lead times could pressure OEMs and delay fleet upgrades through midyear. Read More →

West Coast Ports Brace for Sharp Volume Decline

The Port of Los Angeles anticipates a 35% drop in cargo volume from Asia next week, as major U.S. retailers halt shipments from China amid escalating tariffs. China typically accounts for about 45% of the port's traffic, and this significant reduction is expected to impact operations until a new trade agreement is established. Read More →

FMCSA Moves to Reinstate English Language Requirement

A new executive order directs federal officials to enforce English proficiency standards for commercial drivers. Non-compliance will now be considered an out-of-service violation. The FMCSA has been instructed to revoke previous guidance that downplayed language enforcement, and the CVSA is expected to finalize changes that would enable roadside inspectors to take non-proficient drivers off the road. Federal officials say the move aims to improve road safety and uphold minimum driver qualifications. Read More →

Warehousing & Distribution Services | Expanding Capacity to Meet Demand

As trade conditions evolve, warehousing is playing a bigger role in supply chain agility. UWL offers strategically located distribution centers, integrated technology, and a suite of services designed to help you manage inventory, streamline order fulfillment, and respond quickly to shifting customer demands.

We have Class-A facilities in Newark, Norfolk, Savannah, Tacoma, and Columbus, OH.

Capabilities include:

-

Transloading & Crossdocking near key ports and inland hubs

-

Bonded options – with more bonded capacity pending approval

-

Retail and eCommerce order fulfillment including pick, pack & ship

-

Labeling, kitting, palletizing, and other value-added services

-

Technology integrations with major platforms (EDI, WMS, Shopify, etc.)

-

Seamless connection to in-house drayage and nationwide trucking

From container unloading to last-mile prep, our warehousing network is built to support speed, control, and end-to-end visibility. Reach out to your account rep to discuss warehousing options.

Sun Chief Express Supports Southeast Asia Shift

As shippers rethink sourcing strategies in response to tariff volatility, Southeast Asia—particularly Vietnam—continues to emerge as a critical hub for diversification. Our Sun Chief Express service offers a reliable, direct connection from Vietnam to the U.S., helping customers de-risk supply chains and maintain schedule integrity amid market disruptions.

With consistent weekly sailings, secured space, and end-to-end visibility, Sun Chief Express is a preferred solution for importers shifting volume out of China and looking for predictability across the Pacific.

Looking to adapt your origin strategy? Let’s talk about how Sun Chief can support your Q2 and Q3 freight planning.

-

Expedited Transits: Direct service from Ho Chi Minh City (SPI-TC) to Seattle, offering the fastest transit times on the market.

-

Seamless Rail Connectivity: On-dock rail at Terminal 18 with IPI access to Memphis, Chicago, Minneapolis, Kansas City, and Columbus.

-

Integrated Transload and Distribution Network: 568,000 sq. ft. of Class A transload and distribution space in the Pacific Northwest.

-

In-House Drayage: Our sister company, Pacific Cascade, has a fleet of 65 tractors and 200+ chassis to provide reliable drayage for the service.

Ready to shift volume to Southeast Asia? Contact Chris or Sal from our Sun Chief Commercial team to get started.

Around World Group

|

CPG Acquires Dray Alliance, Upping Stake in LA/Long Beach Market. World Group has acquired Dray Alliance, a tech-driven drayage provider with a strong presence in the LA/Long Beach market. The acquisition enhances World Group’s ability to deliver modern, data-powered drayage solutions in one of the nation’s busiest port regions. |

World Group's WDS and Pacific Cascade support Sun Chief in the PNW. Our WDS Tacoma distribution center offers high-speed crossdocking and transloading to move products from port to shelf faster. Our Pacific Cascade brand also provides warehousing in Sumner and drayage services for the Puget Sound region. Get in touch with us to explore your Seattle - Tacoma distribution options. |

Building on last year’s successful China branch openings, UWL has opened its first office in Indonesia, strengthening our regional presence and enhancing service for local shippers. This expansion builds on the success of Sun Chief Express and UWL’s Vietnam and Cambodia offices, streamlining logistics with local expertise and faster turnaround times. |

.gif?width=1920&name=UWL-SwireShipping-Sun-Chief-Imports-Product-Video%20(1).gif)

.png?width=882&height=882&name=CPG%20+%20Dray%20Alliance%20Acquisition%20Thumbnail%20(350%20x%20350%20px).png)