UWL Freight Market Update | Navigating Tariffs, Rates & Risk

- By:

- UWL

- Date:

- Mar 28, 2025 2:07:41 PM

- Categories:

- International Trade News, Ocean Freight, Supply Chain, Regulatory Updates, Freight Forwarding, Market Updates, North America, Shipping & Logistics News, 3PL, Sun Chief

Your Monthly Logistics Round Up - Timely insights for navigating today's freight markets.

Stay ahead with key insights on global logistics trends and discover how our World Group companies keep your supply chain moving.

In this issue:

-

Customs and Tariff Developments

-

Geopolitics in Focus

-

Global Freight Rate Trends

-

Air Cargo Snapshot

-

Port and Inland Ops

-

Sun Chief Express Featured at TPM25

Customs and Tariff Developments

Section 232 FAQ Update

CBP has added guidance on how to file entries for steel/aluminum-related products that aren't directly subject to 232 measures. Questions cover certificate requirements, value assessments, and treatment of sets.

US-China Trade Escalates Ahead of April Tariffs

President Trump’s trade team is preparing to meet with Chinese counterparts ahead of sweeping new U.S. tariffs set for April 2. The tariffs target Chinese imports as part of broader efforts to combat fentanyl-related chemical flows and rebalance the trade deficit. China responded with 10% retaliatory duties on U.S. oil and LNG. Talks may ease tensions, but port fees on Chinese ships are also being considered.

Reciprocal Tariff Strategy Narrowing

The upcoming tariff rollout is expected to focus primarily on G20 nations, with fewer sectors impacted than initially projected. Details remain fluid as the April 2 date nears.

Geopolitics in Focus

Red Sea Tensions Persist

Houthi forces have resumed attacks on Israeli-linked ships, vowing continued action until the Gaza blockade lifts. U.S. strikes have failed to deter them, and Iran’s calls for restraint were dismissed. Allies remain cautious, but risk of escalation remains high, especially for Gulf shipping routes.

Venezuelan Oil Tariff & Chevron Extension

A new 25% tariff will take effect April 2 on any country importing Venezuelan oil via U.S. trades. The move aims to penalize foreign buyers like China while balancing Chevron’s exit deadline extension through May 27. Beijing has condemned the move, calling it politically motivated.

China Port Fee Proposal Spurs Alarm

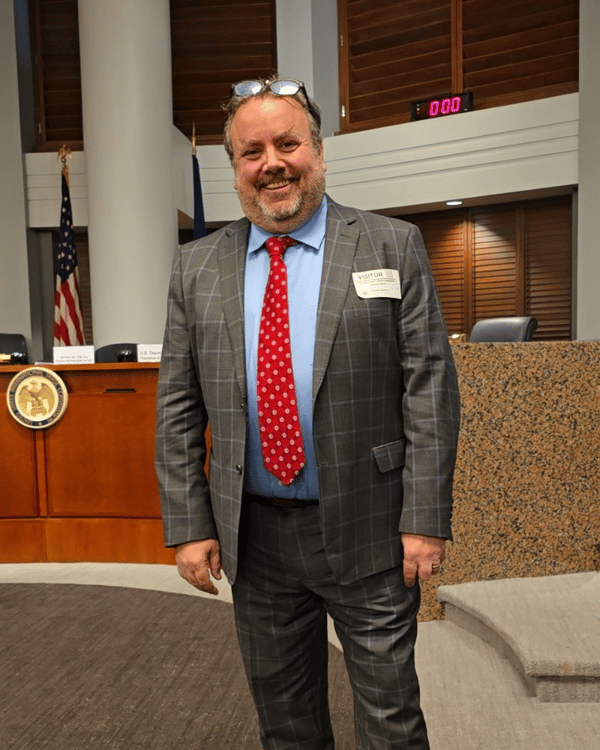

The U.S. is considering fees of up to $1.5 million per port call on Chinese-built ships. Analysts warn the proposal could cost the container shipping industry over $100 billion annually, raise consumer prices, and erode U.S. export competitiveness. Many experts have called for a more measured approach to avoid major disruptions. During a two-day hearing at the USTR in Washington on March 24–25, a panel of shipowners, carriers, and logistics providers—including UWL President and World Group Co-CEO Duncan Wright—shared perspectives on the potential impacts of the proposed fees. The USTR intends to finalize its proposal on or before April 17, 2025.

UWL's Duncan Wright featured at the USTR Section 301 hearing in Washington, DC.

Freight Market Trends

Ocean Freight Snapshot

GRI Hits in April, PSS Unlikely for Now

A $1,000 General Rate Increase takes effect April 1 as carriers attempt to stabilize contract season pricing. Rates may ease later in April, reducing the likelihood of a near-term Peak Season Surcharge—though volatility remains.

Far East → USWC: Down to $2,498, a 36% MoM drop.

Far East → SAEC: $2,022, down 42% MoM.

USWC → Far East: Slight increase to $620, but still trending low. (Source: Xeneta)

Far East – US West Coast Spot Rate Trend (2024–2025) | Source: Xeneta

Xeneta’s recreated trend line illustrates the sharp drop in spot rates since early February, reflecting weak demand and excess capacity. While the GRI is holding for now, signs still point to a soft market. A near-term Peak Season Surcharge (PSS) remains unlikely unless fundamentals shift.

Drewry Index Confirms Global Softening

Drewry’s World Container Index (WCI) fell 4% this week to $2,284 per FEU, its lowest since December 2023.

-

Shanghai → Los Angeles: Down 6% WoW to $2,720

-

Shanghai → New York: Down 5% to $3,725

-

Shanghai → Rotterdam: Down 6% to $2,426

While WCI rates are still 25% higher year-over-year, the six-week slide across major lanes signals post-Lunar New Year momentum is fading. Drewry expects continued easing as market overcapacity weighs on carrier pricing power through Q2.

What's next?

While these projections point toward continued rate easing driven by overcapacity and softened demand, UWL acknowledges that the current ocean freight environment remains highly dynamic. With ongoing geopolitical tensions and potential regulatory shifts, the market could just as easily swing in either direction. We're already seeing signs that 2025 is shaping up to be anything but “normal”—and we're working closely with customers to stay agile and prepared.

Air Freight Snapshot

Asia Tonnage Climbs, London Disruption Causes Delays

Airfreight demand surged 5% in Week 11 across Asia Pacific, with notable increases from China (+6%) and South Korea (+13%). Meanwhile, a March 21 power outage at Heathrow disrupted schedules, forcing reroutes and delays for DG and temp-controlled cargo.

Port and Inland Ops

Baltimore Bridge Collapse Triggers National Infrastructure Review

The NTSB found the collapsed Francis Scott Key Bridge had a failure risk nearly 30 times higher than the acceptable threshold—an oversight that went unaddressed despite past warnings. In response, officials are now reviewing 68 similarly vulnerable bridges across 19 states, including major structures like the Golden Gate and Verrazano-Narrows.

The Dali containership that struck the bridge experienced two power failures the day prior, followed by a final electrical breaker trip moments before impact. The tragedy, which killed six workers, is now driving urgent safety reforms for ports and infrastructure alike.

EPA Rollback Halts Trucking Prebuy Rush

President Trump’s EPA has repealed the 2027 heavy-duty emissions rule, avoiding a predicted spike in truck pre-orders. The policy reversal is seen as a major regulatory win for smaller fleets and owner-operators, who had raised concerns about reliability, high upfront costs ($25K–$30K per unit), and tech readiness.

The decision also helps stabilize truck availability and pricing, keeping near-term capacity more balanced as the industry avoids a repeat of the 2007 emissions transition fallout.

Port of Long Beach Extends Growth Streak

The Port of Long Beach recorded its ninth consecutive month of volume gains in February, handling 765,385 TEUs—a 13.4% YoY increase. Imports were up nearly 12%, while empties surged 19%. With early-year pull-forward activity and leaner inventories at play, the port’s strong showing reflects resilient demand and shippers repositioning ahead of potential tariff changes.

Sun Chief Express Highlighted at TPM25

Sun Chief Express was featured onstage at TPM25 with a panel featuring UWL's Chris Krawczyk and Duncan Wright. Check out some of the key insights in the recap below and hear from our customers about their experience with the service's speed and reliability in getting urgent products to market consistently, and with speed.

Unfamiliar with the service? Check out some of the key highlights below:

-

Expedited Transits: Direct service from Ho Chi Minh City (SPI-TC) to Seattle, offering the fastest transit times on the market.

-

Seamless Rail Connectivity: On-dock rail at Terminal 18 with IPI access to Memphis, Chicago, Minneapolis, Kansas City, and Columbus.

-

Integrated Transload and Distribution Network: 568,000 sq. ft. of Class A transload and distribution space in the Pacific Northwest.

-

In-House Drayage: Our sister company, Pacific Cascade, has a fleet of 65 tractors and 200+ chassis to provide reliable drayage for the service.

Reach out to our Sun Chief Commercial team of Chris and Sal to get started.

Around World Group

|

CPG Acquires Dray Alliance, Upping Stake in LA/Long Beach Market. World Group has acquired Dray Alliance, a tech-driven drayage provider with a strong presence in the LA/Long Beach market. The acquisition enhances World Group’s ability to deliver modern, data-powered drayage solutions in one of the nation’s busiest port regions. |

World Group's WDS and Pacific Cascade support Sun Chief in the PNW. Our WDS Tacoma distribution center offers high-speed crossdocking and transloading to move products from port to shelf faster. Our Pacific Cascade brand also provides warehousing in Sumner and drayage services for the Puget Sound region. Get in touch with us to explore your Seattle - Tacoma distribution options. |

Building on last year’s successful China branch openings, UWL has opened its first office in Indonesia, strengthening our regional presence and enhancing service for local shippers. This expansion builds on the success of Sun Chief Express and UWL’s Vietnam and Cambodia offices, streamlining logistics with local expertise and faster turnaround times. |

.png?width=882&height=882&name=CPG%20+%20Dray%20Alliance%20Acquisition%20Thumbnail%20(350%20x%20350%20px).png)