Transpacific Ocean Freight & Blank Sailings Update | Week 23

- By:

- Kellie Lynch

- Date:

- Jun 5, 2020 12:42:28 PM

- Categories:

- Ocean Freight, Supply Chain, Imports, Exports, Freight Forwarding, Resources, Market Updates, North America, Asia, Shipping & Logistics News, Port Congestion

The crunch continues...

And I’m not talking about your kids smashing Cap'n Crunch cereal while you do your best to simultaneously work and teach from home (or, if you're like me and only have "fur-babies" — I'm not talking about your puppy crunching in the corner on some mystery item he found under the couch)... I mean ocean freight capacity. A space crunch.

The blank sailings scheme carriers have been using for much of 2020 is continuing into June and beyond. The demand for what little capacity remains has caused rates to creep up on many trade lanes. Schedule changes are in the works to hopefully bring some relief and balance in these tumultuous times, but the situation remains fluid.

Let's see what Q3 has in store and take a look at what's going on in the market.

Ocean Freight Market Update

Expect more blank sailings in Q3

Carriers are starting to announce their Q3 schedules. Even with the reinstatement of some voyages, a substantial number of blank sailings is expected as carriers continue their "aggressive" capacity reductions.

According to the JOC, Alphaliner reports a total of "11.6 percent of the container shipping fleet is now idle, reaching a record 2.72 million TEU by the end of May, with 20 percent of the idle capacity (64 ships) being fitted with scrubbers."

Carriers are making big changes to their networks to adjust to new demand flows in the current climate.

On some routes, carriers took too much capacity out, causing a backlog of rolled cargo for shippers. On others, there is still too much capacity for the demand they're seeing, so they’re moving services around to support lanes that are in higher demand. Cancelled arrivals have also led to some ships skipping transshipment ports, causing delays.

Our team is working diligently to keep cargo flowing, staying in constant communication with steamship lines. Should you have any questions or concerns about any of your shipments, contact your LC or reach us here.

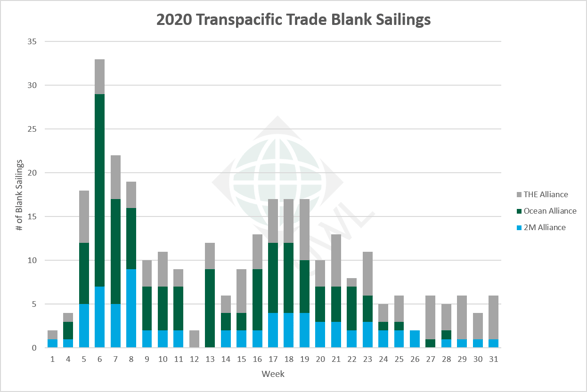

Transpacific Trade Blank Sailings: By the Numbers

Note: In this article, we are focused on cancelled transpacific sailings from East Asia to all USA and Canada destinations. Updated June 15, 2020.

Q3 schedules are still coming out, but here is what we've confirmed so far. We've seen at least 35 cancellations announced from Week 25 to Week 31, however 12 sailings were reinstated in Weeks 25 and 26. We'll continue to update the charts below as more information comes in.

| Total | 2M Alliance | Ocean Alliance | THE Alliance | |

| Q1 | 148 | 36 | 76 | 36 |

| Q2 | 134 | 33 | 50 | 51 |

| Q3 | 21 | 4 | 1 | 16 |

| Total | 303 | 73 | 127 | 103 |

For a complete list of announced blank sailings, download this report.

(Excel .XLSX 1,33 KB) | Updated on June 15, 2020

Capacity remains tight across all major transpacific trade lanes

Asia Pacific to North America

Current space from Asia to the US, especially to the USWC, is extremely tight and rates have increased. "The rolling is out of control, almost 100% rolling for all shipments," said one of our agents in China.

Space to USEC is also getting very tight and weight limits may pose challenges for shippers moving heavier cargoes.

"USEC space was OK in May, carriers did not care too much about the weight, since their first aim was to fulfill the vessels," our agent explained, "However, USEC vessels are full as well from last week and until Week 25."

Carriers are restarting weight limits for sailings transiting the Panama Canal, which could impact shipments, especially those out of Northern China (ex NPRC). "There are numerous heavy cargoes there, which will impact whole vessel overweight," she said.

Trends across China remain the same since our last market update:

- In Central China, all carriers running service from Ningbo (NGB) to Pacific Southwest (PSW) are extremely full. For some carriers, PSW space is subject to "double roll", meaning two-week delays. From Ningbo to both Pacific Northwest (PNW) and the U.S. East Coast (USEC), space is also full due to blank sailings.

- From Shanghai (SHA) to USWC, space is very full as well. Space from Shanghai to USEC/GULF is also tight and some carriers, like ZIM and COSCO, have weight limitations to the USEC.

- In Northern China, space to PSW is extremely full and subject to double roll. Space to PNW is tight, however space to USEC/GULF is normal.

- In Southern China, space from Hong Kong (HKG) to USWC is full and USEC is tight. Shenzen (SZ) space to both USWC & USEC is full. To the USWC, the space situation is much worse.

- From Fujian, space to PNW is normal and PSW is full. Space to USEC is tight, but the empire service of MSC and AWE service of COSCO is full.

- From Taiwan, space to PSW is full and PNW and USEC is tight.

North America to Asia Pacific

Space and equipment remain tight due to blank sailings. Shippers are advised to book at least 2 to 3 weeks in advance.

Latin American Exports

Blank sailings continue to impact freight out of Brazil and Latin America. Capacity remains tight, especially in the WCSA area. However, the equipment situation is improving. In some areas, ports are congested due to COVID-19 restrictions. Delays at transshipment ports are impacting Brazil shipments to and from Europe.

Contact our Brazil team at uwlbra@shipUWL.com if you need any assistance.

Full ships lead to rising rates, trouble securing bookings

Fully booked and overbooked vessels have caused rates to jump.

"The US west coast component of today’s Shanghai Containerized Freight Index (SCFI) leapt 25%,” The Loadstar reported. This was “the highest rate recorded for the trade lane for some 18 months.” Rates to the East Coast also rose.

Challenges securing space have caused some shippers to make multiple bookings for the same container with multiple carriers in an attempt to ensure their cargo moves. Blank sailings are also causing supply chain troubles for exporters, making it difficult to plan export schedules due to the uncertainty.

“Our challenge is getting bookings,” said Rachal DeRosier, global logistics specialist at Johnsonville.

According to JOC, the sausage manufacturer has developed contingency plans to keep products moving, including transporting shipments by long-haul truck to the West Coast rather than rail, or shipping some containers to the East Coast for Asian routings, she said.

Our team is prepared to provide creative solutions to even your toughest logistical challenges. We have reliable trucking capacity and land transportation services, as well as air freight services available should your shipment need to switch modes. Let us know how we can help here.

Containers pile up in China

Delays out of Asia are mounting. "Carriers have wound the supply chain so tight that if one does get a booking, they are not guaranteed space," said WWL's Jon Monroe. "Containers are backlogged for two weeks in S. China."

To deal with the piling containers, carriers have deployed "extra loaders" on some lanes. Extra loaders are additional vessels added to the schedule to temporarily boost capacity when demand is high.

Rise of "No Shows" and cancelled bookings causes problems for carriers

On the other side of the coin, booking cancellations and "no shows" - where the ocean carrier doesn't receive the container(s) that are booked for their voyage - are on the rise.

“While we see that booking confirmations are going up, it remains a challenge that the number of no shows are very, very high,” Hapag-Lloyd CEO Rolf Habben Jansen told the JOC. “There is a problem. No-shows have always been an issue, but on some trades these numbers have moved up to 30 to 35 percent. That is not great.”

No shows make it difficult for ocean carriers to accurately match supply with demand on their services. However, a main contributor to the higher number of no shows has been cancelled purchase orders amid the COVID-19 pandemic.

Additionally, the capacity crunch created an environment where if a shipper has something that must move, they sometimes book the same shipment with multiple carriers to ensure they get space. This is another reason for the rising no shows.

Consumer demand trends: Growth will be "patchy" in 2020

Analysts predict that growth will be slow for the remainder of 2020.

According to research analyst Maritime Strategies International, “While there may be an initial uplift in volumes to meet immediate demand as economies begin to open, there is growing anecdotal evidence that peak season volumes will be lower on a year-on-year basis, and potentially quite sharply so.”

They predict that the uncertainty of the current climate will have consumer-facing industries being cautious with their inventory planning through Q4.

“We certainly expect a sequential improvement in volumes relative to Q2 20, but remain concerned over the likelihood that 'temporary' joblessness will become longer-term, corporate defaults will increase and wage growth will slow,” MSI said.

“Sales of containerised consumer goods have been some of the hardest-hit by lockdown measures, and lower consumer spending power is likely to persist for a prolonged period,” said Peter Sand, chief analyst at BIMCO.

According to The Loadstar, SeaIntelligence founder Lars Jensen agreed.

“Rebound in 2020 will depend on three factors," he said,"firstly, the virus needs to be gone; secondly, if the virus is gone consumers will need to start spending as they did before, and given how many people have lost their jobs this is extremely unlikely; and thirdly, we are shortly entering the peak season, which is when retailers stock up for Christmas – but is any retailer seriously predicting strong Christmas sales this year?"

“My most optimistic prediction of a rebound is 2021,” Jensen said.

So what is a shipper to do?

While July could have more capacity come online, we expect carriers to continue blanking sailings to maintain rate levels — A tactic which has proven successful for them over the past few months.

Our biggest piece of advice right now is to do what you can to forecast and plan ahead. Don't wait until the last minute. Book at least 2-3 weeks in advance whenever possible to secure space and keep your cargo moving.

Also, if you need to cancel your bookings for any reason, please let us (and the carriers) know. Not only is it polite, it could help out another shipper.

If you have any questions, or if we can help you in any way, please reach out.

Additional Resources

To dig a little deeper into this subject, see these other resources below:

- USA Exports: Equipment availability impacts from COVID-19

- Container-News: Latest blank sailing reports

- BIMCO: Latest port status updates

- The Loadstar: 'Aggressive' blanking brings capacity crunch, cargo rolling and rocketing rates

- JOC: THE Alliance to announce Q3 blanks this week

- JOC: Alliances outline extensive blank sailings for Q3

- JOC: Carriers see rise in booking cancellations, no-shows

- COVID-19 Resources: Johns Hopkins Center for Systems Science and Engineering